Solutions

>

> Quandl.search("S&P 500", database_code = "YAHOO")

SPDR S&P 500 (SPY)

Code: YAHOO/INDEX_SPY

Desc: SPY: SPDR S&P 500 (SPY)

Freq: daily

Cols: Date | Open | High | Low | Close | Volume | Adjusted Close

S&P 500 Index

Code: YAHOO/INDEX_GSPC

Desc: GSPC: S&P 500 Index. The S&P 500, or the Standard & Poor's 500, is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ.

Freq: daily

Cols: Date | Open | High | Low | Close | Volume | Adjusted Close

S27: SPDR S&P500 10US$

Code: YAHOO/SI_S27

Desc: Currency: SGD

Freq: daily

Cols: Date | Open | High | Low | Close | Volume | Adjusted Close

I17: IS S&P500 10US$

Code: YAHOO/SI_I17

Desc: There is no Profile data available for I17.SI. Currency: SGD

Freq: daily

Cols: Date | Open | High | Low | Close | Volume | Adjusted Close

MDSRX: Blackrock S&P 500 Index A

Code: YAHOO/FUND_MDSRX

Desc: The investment seeks to match the performance of the Standard & Poor's® 500 Index (the 'S&P 500') as closely as possible before the deduction of fund expenses.

The fund is a 'feeder' fund that invests all of its assets in Master S&P 500 Index Series of Quantitative Master Series LLC, which has the same investment objective and strategies as the fund. It will be substantially invested in securities in the S&P 500, and will invest, under normal circumstances, at least 80% of its assets in securities or other financial instruments that are components of or have economic characteristics similar to the securities included in the S&P 500.

Freq: daily

Cols: Date | Open | High | Low | Close | Volume | Adjusted Close

S&P 500 Dividend Aristocrats (^SPDAUDP)

Code: YAHOO/SPDAUDP

Desc: This dataset has no description.

Freq: daily

Cols: Date | Open | High | Low | Close

S&P 500 Managed Distribution In (^SPXMDUT)

Code: YAHOO/SPXMDUT

Desc: This dataset has no description.

Freq: daily

Cols: Date | Open | High | Low | Close

S&P 500 Dividend Aristocrats (T (^SPDAUDT)

Code: YAHOO/SPDAUDT

Desc: This dataset has no description.

Freq: daily

Cols: Date | Open | High | Low | Close

S&P 500 Managed Distribution In (^SPXMDUP)

Code: YAHOO/SPXMDUP

Desc: This dataset has no description.

Freq: daily

Cols: Date | Open | High | Low | Close

Ishares S&P 500 (IVV.AX)

Code: YAHOO/ASX_IVV_AX

Desc: Historical stock prices for Ishares S&P 500 (IVV.AX). The fund invests at least 90% of assets in S&P 500 index securities. The index measures the performance of the large-capitalization sector of the U.S. equity market. As of May 31, 2010, the index included approximately 75% of the market capitalization of all publicly-traded U.S. equity securities.

Freq: daily

Cols: Date | Open | High | Low | Close | Volume | Adjusted Close

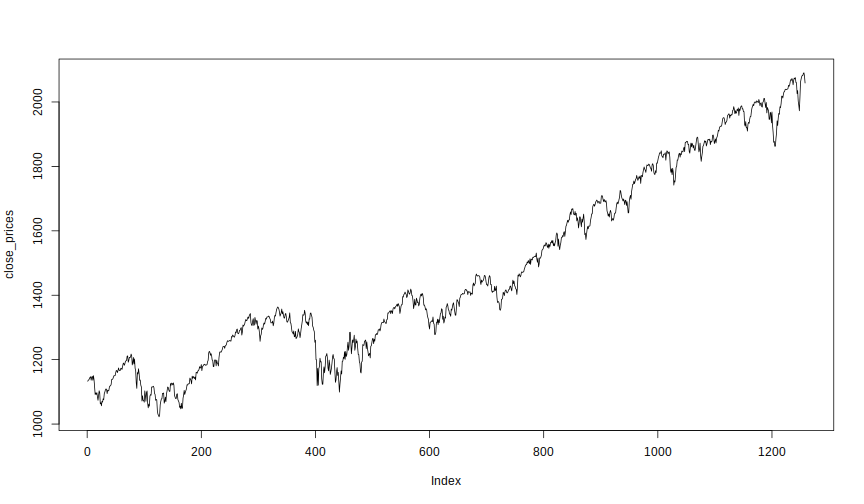

> sp500 <- Quandl("YAHOO/INDEX_GSPC.4",

+ start_date = "2010-01-01", end_date = "2014-12-31",

+ order = "asc")

>

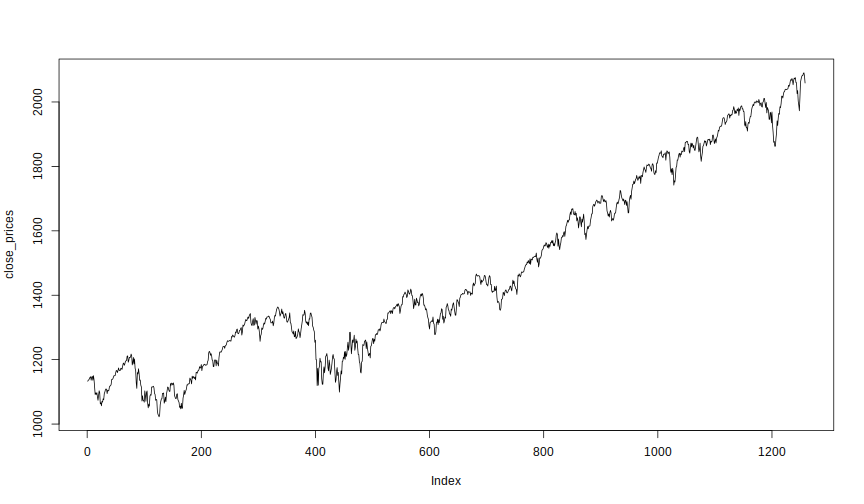

> close_prices <- sp500[,"Close"]

>

>

> plot(close_prices, type = "l")

> plot(log(close_prices), type = "l")

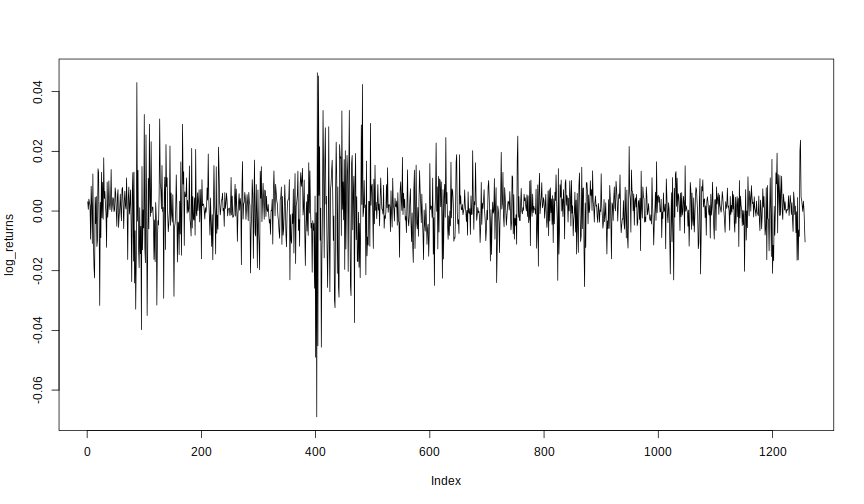

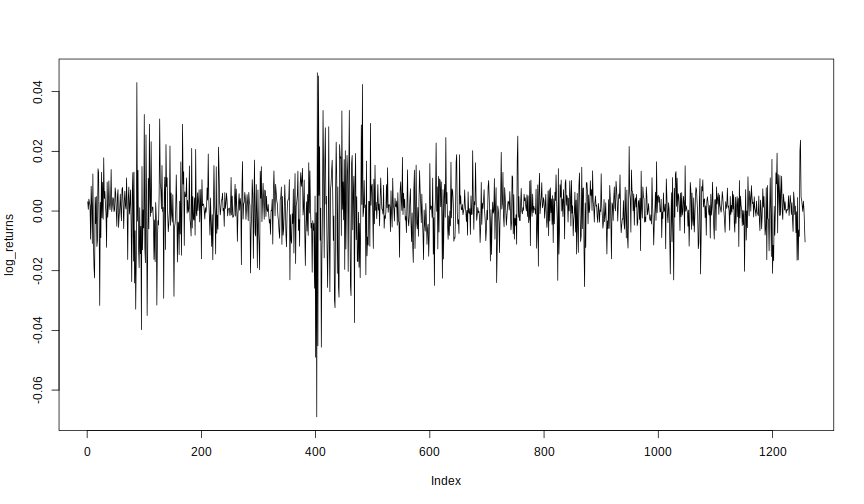

> log_returns <- diff(log(close_prices))

> plot(log_returns, type = "l")

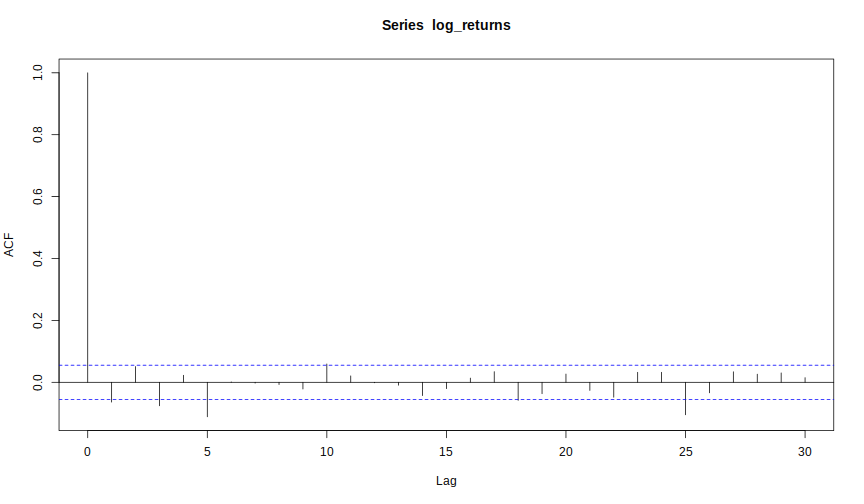

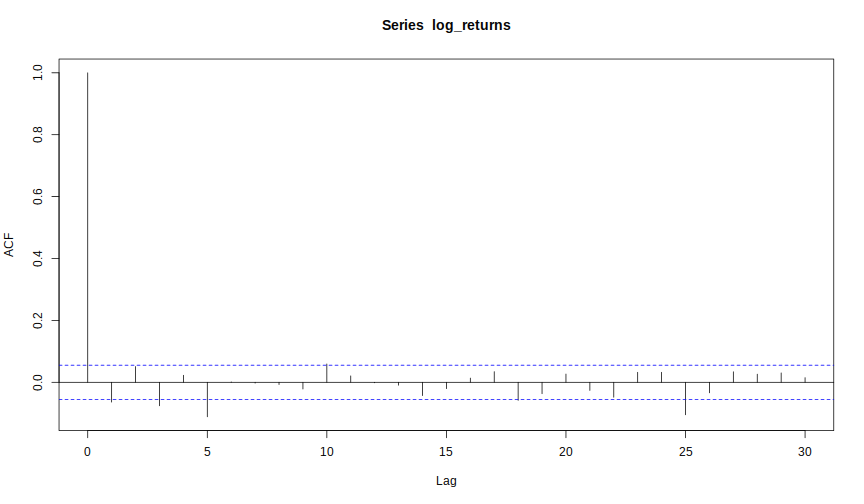

> acf(log_returns)

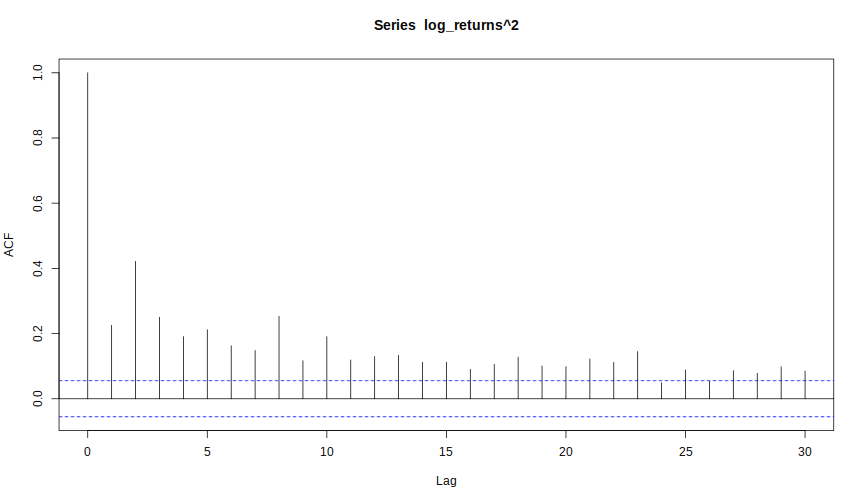

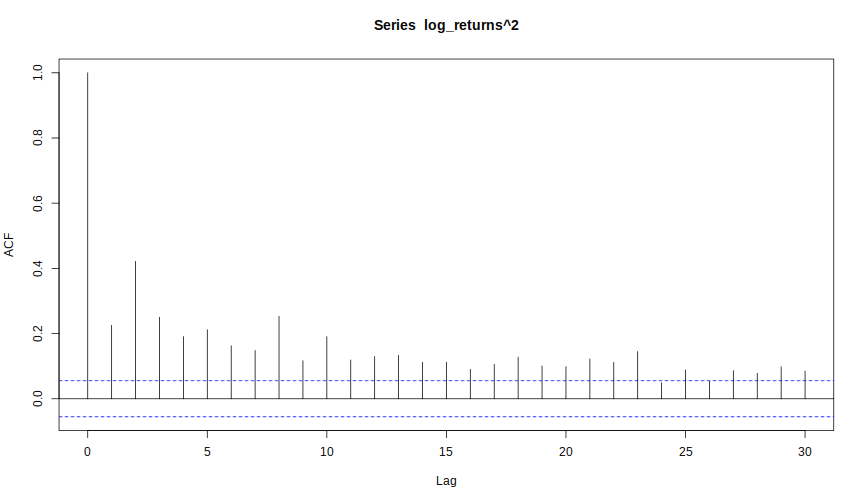

> acf(log_returns^2)

>

> garch_fit <- garchFit(formula = ~ garch(1,1), data = log_returns,

+ include.mean = FALSE, trace = FALSE)

>

> fGarch::summary(garch_fit)

Title:

GARCH Modelling

Call:

garchFit(formula = ~garch(1, 1), data = log_returns, include.mean = FALSE,

trace = FALSE)

Mean and Variance Equation:

data ~ garch(1, 1)

[data = log_returns]

Conditional Distribution:

norm

Coefficient(s):

omega alpha1 beta1

3.4478e-06 1.3105e-01 8.3410e-01

Std. Errors:

based on Hessian

Error Analysis:

Estimate Std. Error t value Pr(>|t|)

omega 3.448e-06 8.287e-07 4.161 3.17e-05 ***

alpha1 1.310e-01 2.094e-02 6.257 3.92e-10 ***

beta1 8.341e-01 2.310e-02 36.109 < 2e-16 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Log Likelihood:

4171.777 normalized: 3.318836

Description:

Mon Sep 21 23:55:09 2015 by user:

Standardised Residuals Tests:

Statistic p-Value

Jarque-Bera Test R Chi^2 105.2718 0

Shapiro-Wilk Test R W 0.980603 6.029324e-12

Ljung-Box Test R Q(10) 10.61118 0.3886017

Ljung-Box Test R Q(15) 14.0323 0.523081

Ljung-Box Test R Q(20) 16.99841 0.6530769

Ljung-Box Test R^2 Q(10) 18.928 0.04118679

Ljung-Box Test R^2 Q(15) 25.2936 0.04613669

Ljung-Box Test R^2 Q(20) 28.62356 0.0954406

LM Arch Test R TR^2 20.3511 0.06072906

Information Criterion Statistics:

AIC BIC SIC HQIC

-6.632898 -6.620639 -6.632910 -6.628291

> garch_fit_std <- garchFit(formula = ~ garch(1,1), data = log_returns,

+ cond.dist = "std", include.mean = FALSE, trace = FALSE)

>

> fGarch::summary(garch_fit_std)

Title:

GARCH Modelling

Call:

garchFit(formula = ~garch(1, 1), data = log_returns, cond.dist = "std",

include.mean = FALSE, trace = FALSE)

Mean and Variance Equation:

data ~ garch(1, 1)

[data = log_returns]

Conditional Distribution:

std

Coefficient(s):

omega alpha1 beta1 shape

3.4572e-06 1.3286e-01 8.3737e-01 5.7242e+00

Std. Errors:

based on Hessian

Error Analysis:

Estimate Std. Error t value Pr(>|t|)

omega 3.457e-06 1.046e-06 3.305 0.00095 ***

alpha1 1.329e-01 2.686e-02 4.946 7.58e-07 ***

beta1 8.374e-01 2.784e-02 30.075 < 2e-16 ***

shape 5.724e+00 1.027e+00 5.574 2.49e-08 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Log Likelihood:

4194.235 normalized: 3.336702

Description:

Mon Sep 21 23:55:09 2015 by user:

Standardised Residuals Tests:

Statistic p-Value

Jarque-Bera Test R Chi^2 105.7119 0

Shapiro-Wilk Test R W 0.9805931 5.976025e-12

Ljung-Box Test R Q(10) 10.70223 0.3811829

Ljung-Box Test R Q(15) 14.11272 0.5169982

Ljung-Box Test R Q(20) 17.0778 0.6479163

Ljung-Box Test R^2 Q(10) 19.13703 0.03855632

Ljung-Box Test R^2 Q(15) 25.5461 0.04307303

Ljung-Box Test R^2 Q(20) 28.90868 0.08957304

LM Arch Test R TR^2 20.5752 0.05695793

Information Criterion Statistics:

AIC BIC SIC HQIC

-6.667041 -6.650695 -6.667061 -6.660898

>

>

> garch_fit@fit$ics

AIC BIC SIC HQIC

-6.632898 -6.620639 -6.632910 -6.628291

> garch_fit_std@fit$ics

AIC BIC SIC HQIC

-6.667041 -6.650695 -6.667061 -6.660898

>

> vola_forecast <- function(fit, n.ahead=1) {

+

+ vola <- numeric(n.ahead + 1)

+ coefs <- coef(fit)

+ h_init <- [email protected][length([email protected])]

+ eps <- fit@residuals[length(fit@residuals)]

+

+ h <- coefs["omega"] + coefs["alpha1"] * eps^2 +

+ coefs["beta1"] * h_init

+

+ if(n.ahead == 1) {

+ res <- h

+ names(res) <- NULL

+ return(sqrt(res))

+ } else {

+ vola_part1 <- coefs["omega"] *

+ (1 - (coefs["alpha1"] + coefs["beta1"])^(1:(n.ahead-1)))/

+ (1 - (coefs["alpha1"] + coefs["beta1"]))

+

+ vola_part2 <- (coefs["alpha1"] + coefs["beta1"])^(1:(n.ahead-1)) * h

+

+ vola <- vola_part1 + vola_part2

+ res <- c(h,vola)

+ names(res) <- NULL

+ return(sqrt(res))

+ }

+ }